Green food consumption is no longer a niche but a mainstream movement in advanced markets. Consumers in Korea, Japan, and Europe increasingly prioritize organic, eco-friendly, and health-conscious products, driven by climate awareness, regulatory frameworks, and generational value shifts. For Vietnamese agri-food businesses, understanding these patterns is crucial to capturing export opportunities and aligning with sustainable trade requirements.

Regional Insights

Korea: Rapid Growth in Organic and Eco-Labeled Food

Market size: South Korea’s organic food market surpassed USD 1.3 billion in 2022, with annual growth above 10%.

Drivers: Post-pandemic health concerns, government eco-certification schemes, and rising middle-class purchasing power.

Notable trend: Increasing demand for plant-based alternatives and functional foods (e.g., ginseng-infused beverages).

Japan: Tradition Meets Modern Sustainability

Market size: Organic food sales in Japan exceed USD 1.5 billion annually, though lower than EU per capita consumption.

Consumer behavior: Strong emphasis on food safety, traceability, and minimal additives.

Trend: Urban millennials and Gen Z are adopting vegetarian or flexitarian diets, while traditional markets emphasize local, seasonal produce.

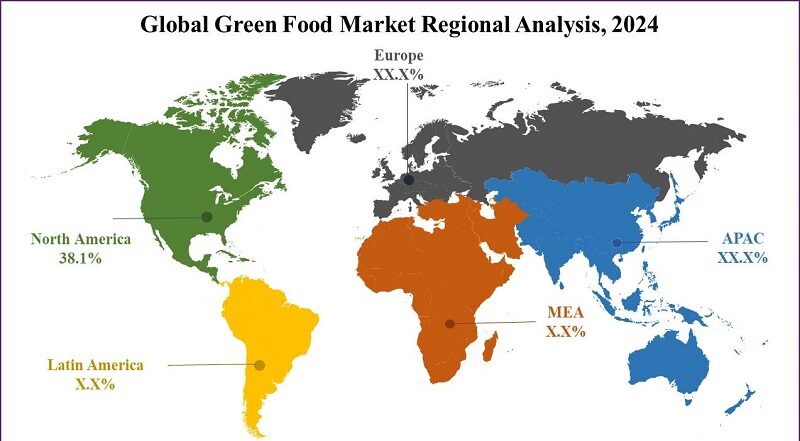

Europe: World Leader in Green Food Consumption

Market size: Europe accounts for over 40% of global organic food sales (Germany, France, and the UK leading).

Policies: EU’s “Farm to Fork” strategy targets 25% organic farmland by 2030.

Consumer demand: High willingness to pay premiums for certified organic, fair-trade, and low-carbon footprint products.

Key Drivers Across All Three Regions

Health & Wellness Priorities: Consumers link green food with disease prevention and longevity.

Climate & Environmental Concerns: Awareness of carbon footprints and sustainability in supply chains.

Government Regulations & Subsidies: Certification standards (EU Organic, JAS in Japan, Korean eco-labels) create strong frameworks.

Generational Shifts: Millennials and Gen Z are pushing veganism, plant-based diets, and ethical sourcing.

Consumer Segments

Urban Millennials & Gen Z: Eco-conscious, digital-savvy, and willing to pay for authenticity.

Middle-Class Families: Prioritize safe, traceable food for children; strong buyers of organic staples.

Premium Shoppers: Wealthy consumers prefer imported organic and functional superfoods.

Flexitarians: A growing segment blending traditional diets with plant-based choices.

Opportunities for Vietnam

Organic Certifications for Export: Vietnamese producers must adopt EU Organic, JAS, and Korean eco-label certifications to gain access.

High-Value Crops and Superfoods: Coffee, tea, tropical fruits, and rice marketed as organic, fair-trade, or carbon-neutral have strong demand.

Processed and Functional Foods: Vietnam can develop plant-based snacks, herbal teas, and functional rice products for health-conscious markets.

Digital Marketing & E-commerce: Online grocery platforms in Korea, Japan, and Europe are rapidly expanding; exporters should leverage digital sales channels.

Sustainability Storytelling: Highlighting low-carbon farming, farmer–community partnerships, and social impact resonates with eco-consumers.

Green food consumption in Korea, Japan, and Europe demonstrates a profound shift toward sustainability, health, and ethics in dietary choices. These trends create clear export opportunities for Vietnamese agribusinesses, but only if they align with global certifications, traceability systems, and sustainability narratives. The race to capture this green premium market has begun — Vietnam can position itself as a trusted supplier of eco-friendly foods with the right strategy.